Health Insurance Cost

This is something you will hear from me a lot, really upset by the health insurance cost scandal and the overall healthcare cost.

I am one of the fortunate who have their company pay for insurance, medical, dental and vision – plus a generous HSA contribution. My total cost is around $300 per month with $2,500 deductible and no copay. According to our CFO, my company’s contribution to employees’ plan is $486 per month – the total cost is $786 per employee.

Every year I do compare with my state’s ACA (Obamacare) for a similar plan. I do not base my search on my actual paycheck but I pick a couple who has a taxable income of $50,000.

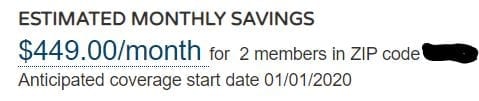

First thing first – let’s see what does my couple qualify for:

Almost $450 tax credit, not bad at all – as many 2020 election candidates say, the wealthy pay for it:)

In my simulation, I have access to 38 plans – excellent, let’s look at a few of them – all HSA eligible.

Plan one – highly recommended by my state:

A total cost of $251.65 + $449.00 (tax break) or about $700 a month. Nice $86 cheaper per month than my company. No copayment, HSA eligible… oh, what is that: $13,600 deductible? Meaning that before the insurance kicks in my couple needs to pay $13,600… compare to my $2,500 deductible it’s too much.

Let’s look at a low deductible plan – oopsy, there no available plan with a $2,500 deductible… the lowest I can find is this one

The total cost jumps to $1,026.47 way above my company plan, the deductibles are at $6,000 and copayment at 20%!

The total cost jumps to $1,026.47 way above my company plan, the deductibles are at $6,000 and copayment at 20%!

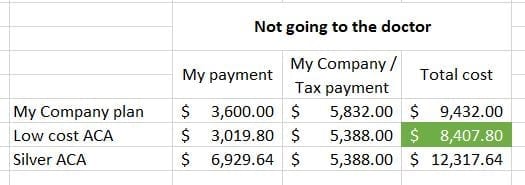

Oh, I see a well-known candidate tells me I got it all wrong, I should look at the total yearly cost and not the calculation I’m doing… Sorry Senator X, I’m checking my yearly numbers right away.

My Senator is totally RIGHT!!!! The low-cost ACA is cheaper by $1,000 – no dental or vision but $1,000 is a $1,000!

What? I know we do go to the doctor… Let’s check again.

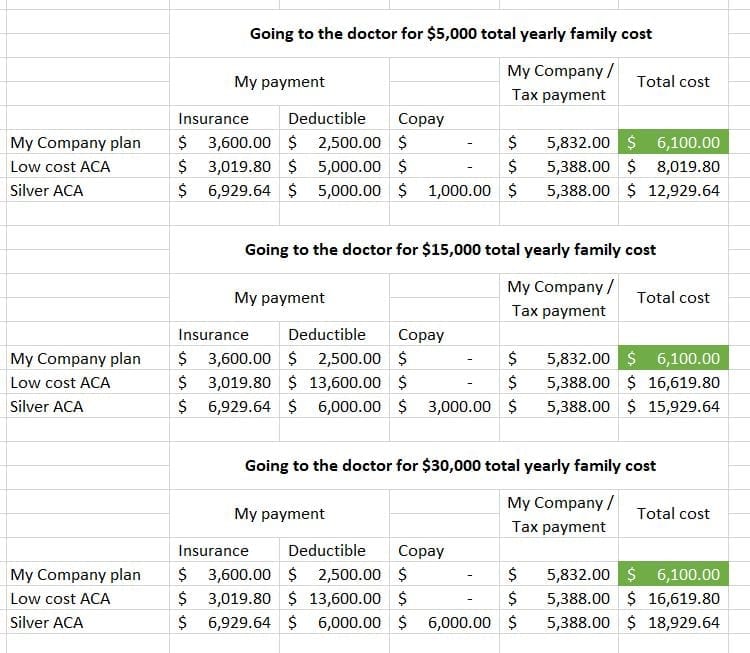

Going to the doctor is not fun, personally I hate it. Looking at the comparison, spending $5,000, $15,000 or $30,000 per year makes my company-sponsored insurance plan cheaper by at least $2,000 per year.

I am very sorry… why in the world a small company like ours has a much better coverage than the gigantic 20 million people on an ACA plan? Don’t cry at fake news… it’s all verifiable.

That is not the biggest problem of health insurance yet.

How many people on a Bronze ACA plan can’t afford to go to the doctor? why? Look at the F######g deductible – $13,600 before insurance kicks in… Meaning they have to pay for everything before it’s paid for… Doctor visits… about $75 – $199, Dentist, meds…

Guess who enjoys these people who avoid the doctor’s office… let me think… oh, 39% of people on ACA with income lower than $75,000 avoid the doctor’s office… How many? not too may some 5,000,000 families in that income bracket and on ACA… Let’s see how much they pay to insurances:

39 % of 5,000,000 on the basic plan at $250 a month = $487,000,000 a month or $5.8 billion a year paid for by families who can’t afford to go to the doctor because of deductibles!

What do we pay as taxpayers? In my couple case $449 * 39% * 5,000,000 * 12 months = $10 billion a year!

That’s a total of almost $16 billion health insurance companies get every year without spending a penny in coverage.

Can I say it? WTF!

Looking at OpenSecrets, I can see those healthcare donors financing my senator campaign by 30%… lol no way they want to change anything. Free guaranteed money is always very good.

If I look at myself, married, on Lipitor with a good income – I do not qualify for tax assistance and I picked the lowest deductible:

Can someone tell me WHY my ACA plan would cost $214 more per month, 20% copay and $6,000 deductible?

A plan at the same cost as I have today (including my company contribution) has a $13,600 deductible!

I contacted my senator whose campaign is funded by 30% by “healthcare donors” but I didn’t receive any answer. Maybe the subject is not an issue 🙂

What do you think?

Leave a Reply